10.It is simply a function of supply and demand.

Clearly the price of oil is due to more than simple supply and demand. While the supply/demand relationship has tightened, there has been no significant change in supply and demand since a year ago and during that time the price of a barrel of light sweet crude has doubled. Supply and demand is the most important long term factor, but it is not the whole story for the latest bull run in energy.

Clearly the price of oil is due to more than simple supply and demand. While the supply/demand relationship has tightened, there has been no significant change in supply and demand since a year ago and during that time the price of a barrel of light sweet crude has doubled. Supply and demand is the most important long term factor, but it is not the whole story for the latest bull run in energy.

9.If we allow offshore drilling and drilling in ANWR the environment will suffer.

In some sense this is true, if we are thinking only of America (which, given our ethnocentrism that is often all we are thinking of.) Demand will increase. Supply will increase in kind. The only question is where the supply will come from. If we do not increase our supply, the increase will happen somewhere else like Saudi Arabia or some small African country being exploited for their oil. The US is likely better than anyone else at preserving the environment while drilling. But hey, as long is its not in our backyard, right?

8.Oil companies are gouging consumers with their record profits.

It is true that Exxon Mobil has had record profits during its recent quarters. It is also true that they are the largest company in the US. I don't know about you, but when I hear that the largest company has the largest proft in dollar terms I think, "Well, that makes sense." We may as well say that New York is gouging its citizens because they collected $63M in taxes while North Dakota collected on $1.7M. If we look at a true comparable measure of profit, profit margin, we see that ExxonMobil saw a profit margin of about 8.5% the last quarter. There are more than 1800 companies with a larger profit margin in the US.

7.A windfall profits tax on big oil will put money in the pockets of average Americans without raising the cost of gas.

Mr. Obama has advocated taxing big oil like ExxonMobil and return that money back to those who have to suffer through these high gas prices. I don't blame Obama for the bad idea- it was probably from an advisor, but he really needs to screen those. Exxon has a duty to its shareholders (many of whom are invested in mutual funds and are living off the dividends from that stock) Exxon will protect its profit because that is how it pays its dividends. Should their taxes increase, costs will go up, thus gas prices will go up. Oddly enough, the people who would benefit the most are the ones who are affected the least by gas prices. Americans would all get the same $1000 relief check, but when that causes gas prices to go up, the largest consumers of gas (generally truck drivers and owners of older, less efficient cars) would hurt the most.

6.We can lower energy cost by investing government funds in alternative energies.

This one gets a partial fallacy. Temporary government incentives can jump start new technologies that may have a positive impact on our energy situation. The problem is that it can also actually make it worse. Ethanol is a great example. It is not now economically viable without significant subsidy, and it is unlikely to ever be. The alternative energy that will be a long term solution will be the one that is simply cheaper without subsidy. Even if the US managed to legislate the use of cleaner but more expensive energy do you really see developing countries like China signing up for that? Me neither.

5.Oil from offshore drilling will not be available for 7-10-15-20 years (the number of years seems to grow with each news cycle).

The nearest Outer Continental Shelf (OCS) sites could be in production within 3-4 years; those further out are likely to see production in 5-7 years. The most difficult site that has no preparation yet could be as long as 7-10 years away. The EIA's now famous 2007 study predicted that the areas in question could reach significant production by 2017, but they also assumed that the moratorium would remain until 2012. That means five years from the moratorium lift. That could be lifted any day Congress decides to come back from vacation and accomplish something.

4. Estimates put the total oil available in the OCS at less than 20 billion barrels.

The simple explanation is that these figures are based on an outdated system that has since been improved for locating and quantifying oil and natural gas deposits. These figures are also based on $50/barrel oil prices. When determining the amount of deposits, the only deposits that are included are those that can be extracted for less than $50/barrel. That means that deposits that would not be economically viable at $50/barrel were excluded. There are a great deal more sites that are economically viable now that oil has surpassed $100/barrel. (There is information on that if the report linked above, or for shorter mentions at these Washington Post and Slate articles)

3.1-2 million barrels of oil per day (the amount estimated in the OCS proven reserves) is only 1.5% of world production, thus not enough to significantly impact the price of oil.

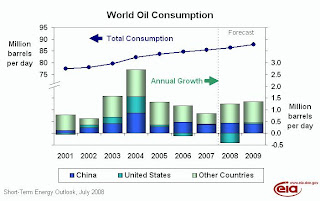

The important number to consider is not the percentage of worldwide production. The important figure is the gap between supply and demand. The closer the supply and demand number are, the higher the price will go and the more volatile the market will be. This graph shows the surplus daily supply. As you can see the surplus in 2008 is around 1.5 million barrels/day. An increase in world supply of 1-2 million barrels/day would double that spread. That is significant, and would have a terrific impact on the price of crude oil.

The important number to consider is not the percentage of worldwide production. The important figure is the gap between supply and demand. The closer the supply and demand number are, the higher the price will go and the more volatile the market will be. This graph shows the surplus daily supply. As you can see the surplus in 2008 is around 1.5 million barrels/day. An increase in world supply of 1-2 million barrels/day would double that spread. That is significant, and would have a terrific impact on the price of crude oil.

2.Simply opening the strategic oil reserve will have a significant impact of gas prices.

The strategic oil reserve is capable of releasing about 4 million barrels/day for about 17 days. It is possible that this could have some impact on price, but it is likely to have an impact of only a few cents for a few weeks at best. If it were a long term source of additional production, its impact would be much greater, but it is not. As part of a larger increased drilling strategy it could play a more significant role.

1.Oil companies already have 68 million acres of land that they are simply choosing not to drill on. If they would drill on those acres they could "nearly double total U.S. oil production."

I hope I do not have to hear this one much longer. Democrats are trying to pass a bill that would require oil companies to use current leases are loose them. The bill proposal says that if they use all the land they currently occupy they could double their production. This is extremely unlikely. To start with, most of that land has been explored and does not have enough oil to warrant drilling. Some is seismically unstable. The doubling number comes from assuming that the unused land would be just as productive as the currently productive land. The fact that the unused land has been virtually completely explored and deemed inaccessible or unprofitable was simply ignored. Not the best reasoning skills there. If oil companies could produce more oil and sell it for $130-140/barrel, I assure you they would.